FINTRUX

What's FINTRUX?

FintruX Network is a blockchain based online ecosystem connecting borrowers, lenders, and rated service agencies. FintruX facilitates marketplace lending in a true peer-to-peer network to ease the cash-flow issues of small businesses and startups.

FintruX is a blockchain project that provides a peer-to-peer (P2P) network for marketplace lending. Their platform connects borrowers, lenders, and servicing agents, which allow them to construct each borrower contract in real-time. This provides a level of efficiency that is not realistic with today's lending marketplaces. Better efficiency is only one of many benefits this platform provides though.

Benefits to Borrowers

Access to Affordable Credit. Our innovative marketplace model, online delivery, process automation, and credit enhancements enable us to offer borrowers interest rates other P2P lending platforms and traditional banks, not to mention credit cards.

Superior Borrowing Experience. We offer a fast and easy-to-use online application process and provide borrowers with access to live support and online automation throughout the process and for the lifetime of the financing. Our goal is to form long-term relationships with borrowers, facilitating their access to an array of financial products that meet their evolving needs over time.

Branding Opportunity. Lenders can provide ratings and transparent reviews on a blockchain to establish trusted borrowers and agents within the ecosystem. With better ratings, borrowers can save on interest rates on subsequent loans. Moreover, borrowers can share their opinion and provide a basis of comparability between different lenders.

Transparency and Fairness. Each customer contract is written as a fully-customized smart contract on a blockchain. It is secure, transparent, immutable, and censorship resilient. Historical data and expected obligations are at borrower's fingertips

Lowered Transaction Fee. Consequently, since each smart contract is fully-customized and simplified for each borrower contract, it is much easier to understand and without ambiguity. No more "if ... then ... else" statements and unnecessary code. Smaller programs lead to lower gas fee; in fact, this is paid for by FintruX. Network.

Super-Fast and Efficient Funding. We leverage online data and intelligent technology to instantly match risk, credit rating and any unique parameters. Borrowers can evaluate options and are instantly matched to lenders of their choice without impacting their credit score.

Self-service. All available options such as refinance, prepayments, etc. can be done online within minutes, on all devices including mobiles.

Benefits to Lenders

Access to Risk-Reduced Investing. Credit enhancements historically only available to securitization funding of large portfolios is now available to lenders on FintruX Network. By applying cascading credit enhancements, FintruX loss.

Superior Lending Experience. We offer a fully automated application process and provide lenders with access to live support and online tools throughout the process and for the lifetime of the financing. Our goal is to form longterm relationships with lenders, facilitating their relative risk-free offerings to their borrowers.

Branding Opportunity. Borrowers can provide ratings and transparent reviews on a blockchain to establish trusted lenders within the ecosystem. With better ratings, lenders can build up their brand and reputation. Moreover, lenders can gain access to qualified feedback and market research data provide services to borrowers.

Access to a Network of Expertise. A network of rated agencies such as fraud, identity, credit scoring and credit decision are readily available.

Attractive Returns. By having access to lower risk of funding and cutting major costs associated with the financing, these savings become additional profit margins. Once their decision tables are selected and configured, this can generate revenue while the lenders spend time with their families.

No Upfront Cost to Lenders. No lump-sum license fee, no fee enhancement, no maintenance fee, no support fee for a system; in fact, no upfront cost is necessary. The only fee for a lender is a transactional based fee and servicing cost that can be transferred to the borrowers. Each financing is managed programmatically by individual and independent smart contract. It is essentially a self-serve engine for the borrowers; saving labor and time servicing the borrower contract.

More Satisfied Customers. Self-service increases customer satisfactions. It is fast, efficient, transparent and time saved to service their borrowers better. More satisfied customers can turn into more business.

The Issues Plaguing Traditional Financing:

- Significant Collateral Required

- Stringent Requirements

- Impossible Rates and Terms.

THE SOLUTION

The FintruX Network FintruX Network makes it easy for small businesses to secure secure loans with no collateral, in any currency.

The three main competitive advantages of FintruX are:

- CREDIT ENHANCEMENTS

- NO-CODE DEVELOPMENT

- OPEN ECOSYSTEM

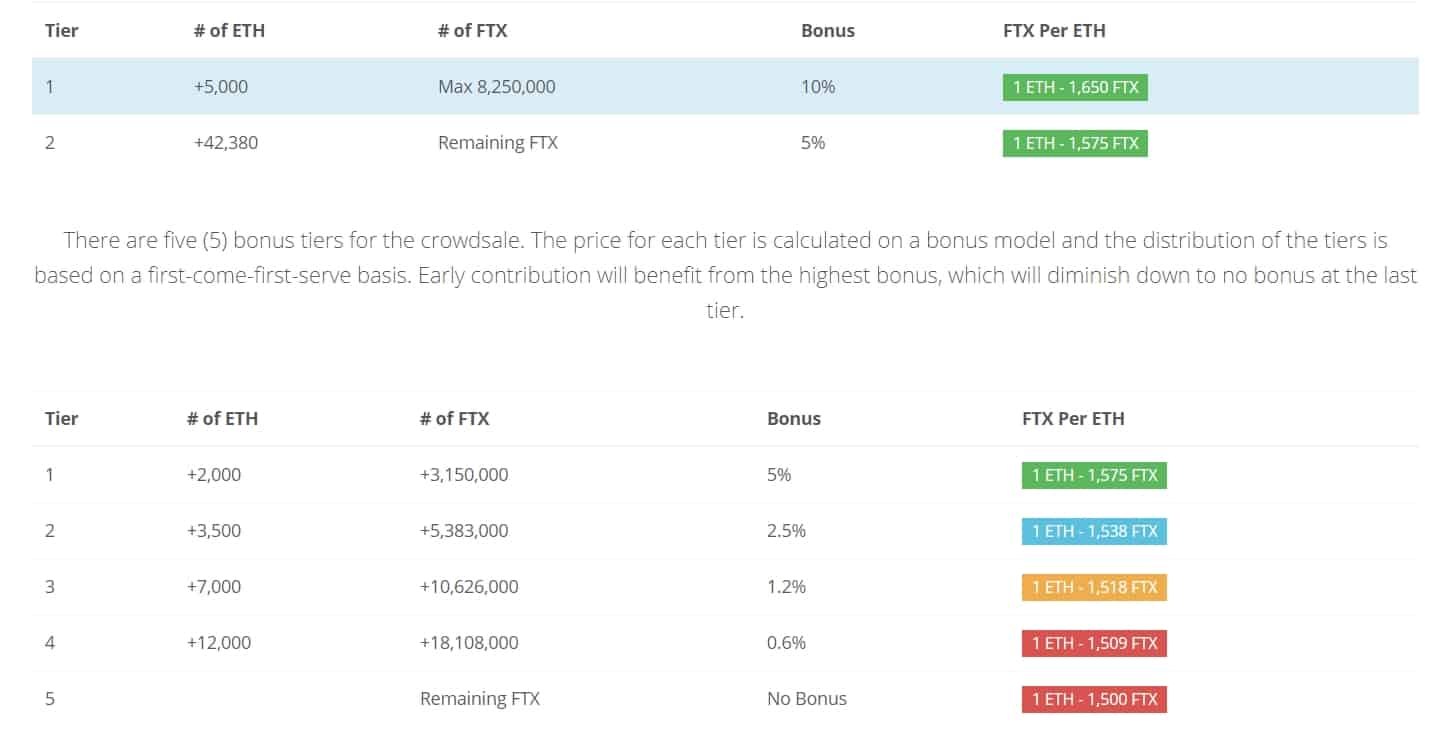

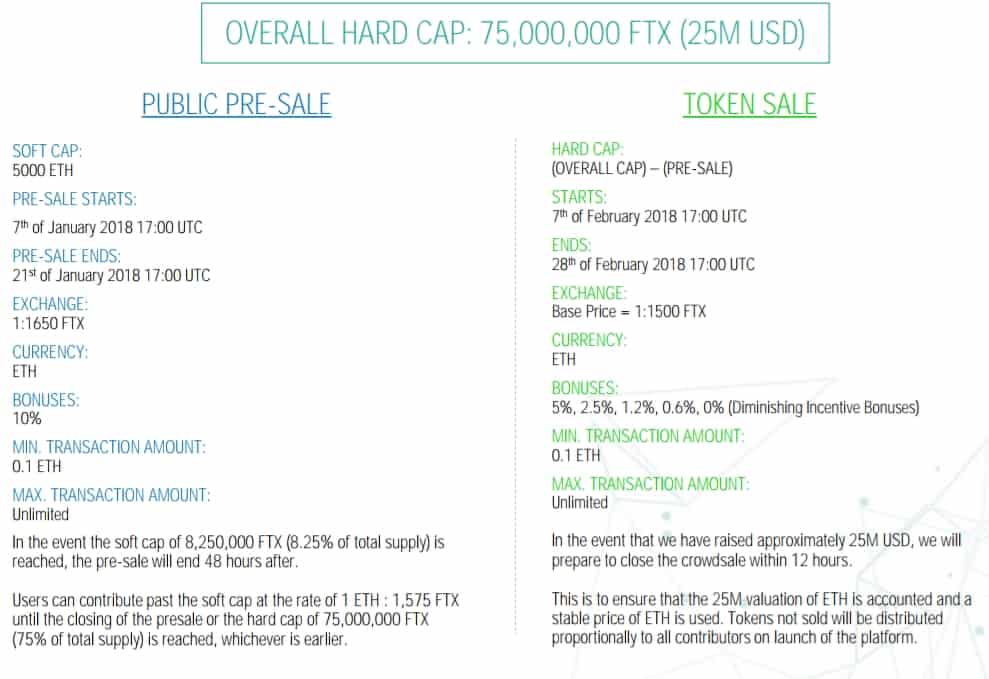

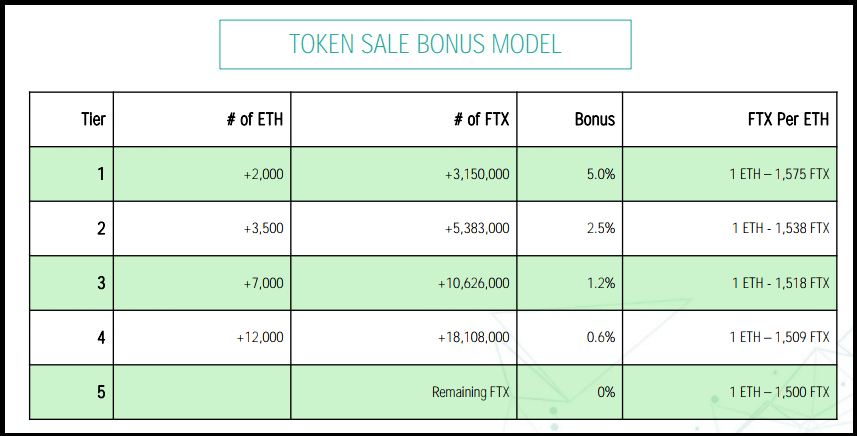

FTX Bonus Models

If above my planning is less clear please see website below:

website :https://www.fintrux.com/

whitepaper :https://www.fintrux.com/home/doc/whitepaper.pdf

telegram :https://t.me/FintruX

facebook :https://www.facebook.com/fintrux

twitter :https://www.twitter.com/fintrux

reddit :https://www.reddit.com/r/fintrux

author: Demoltion

ETH: 0x62b0f6A288263DaFCD6F8831d06fa3586daBb0ab

Komentar

Posting Komentar